Where Do Property Taxes Go?

Local taxing districts

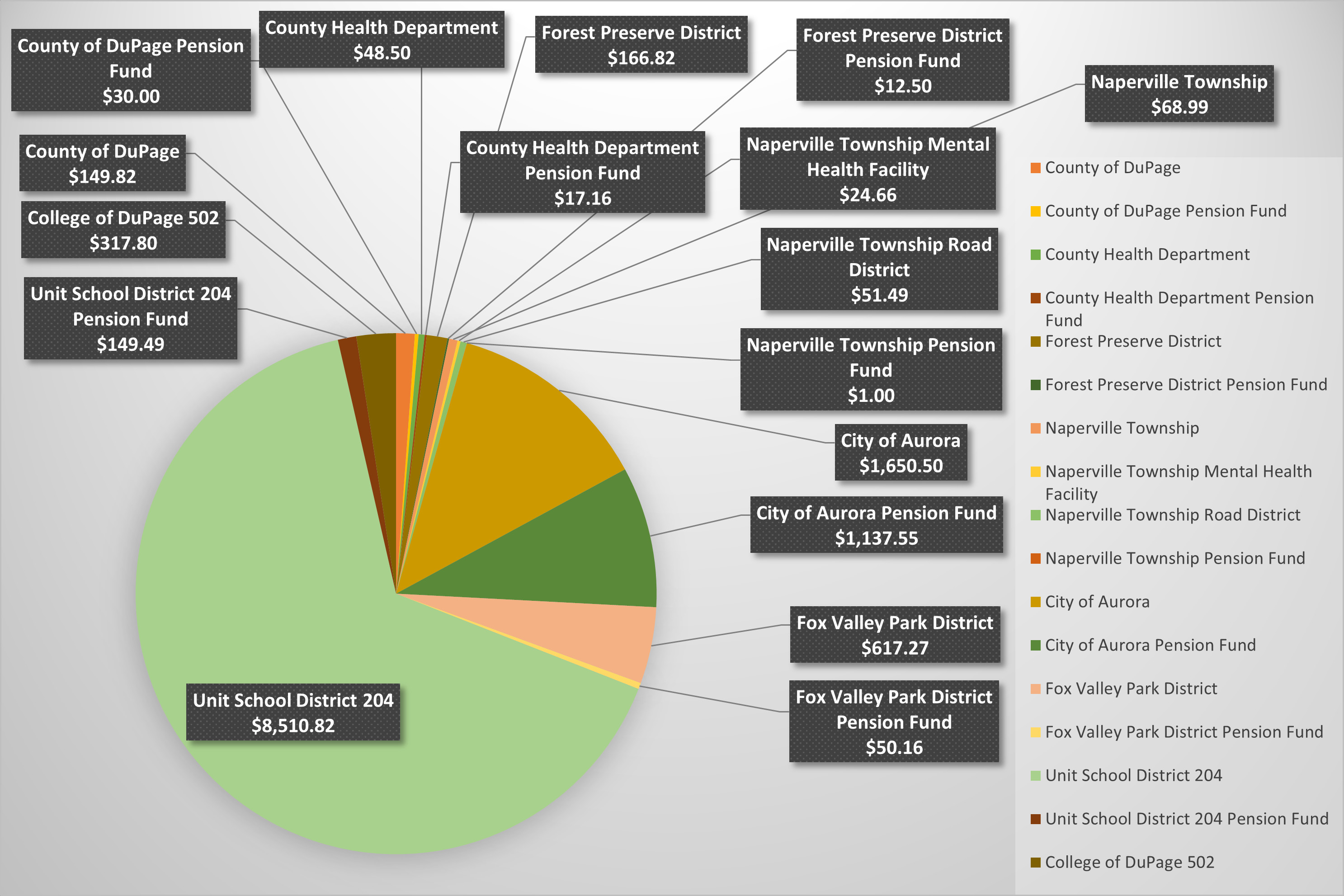

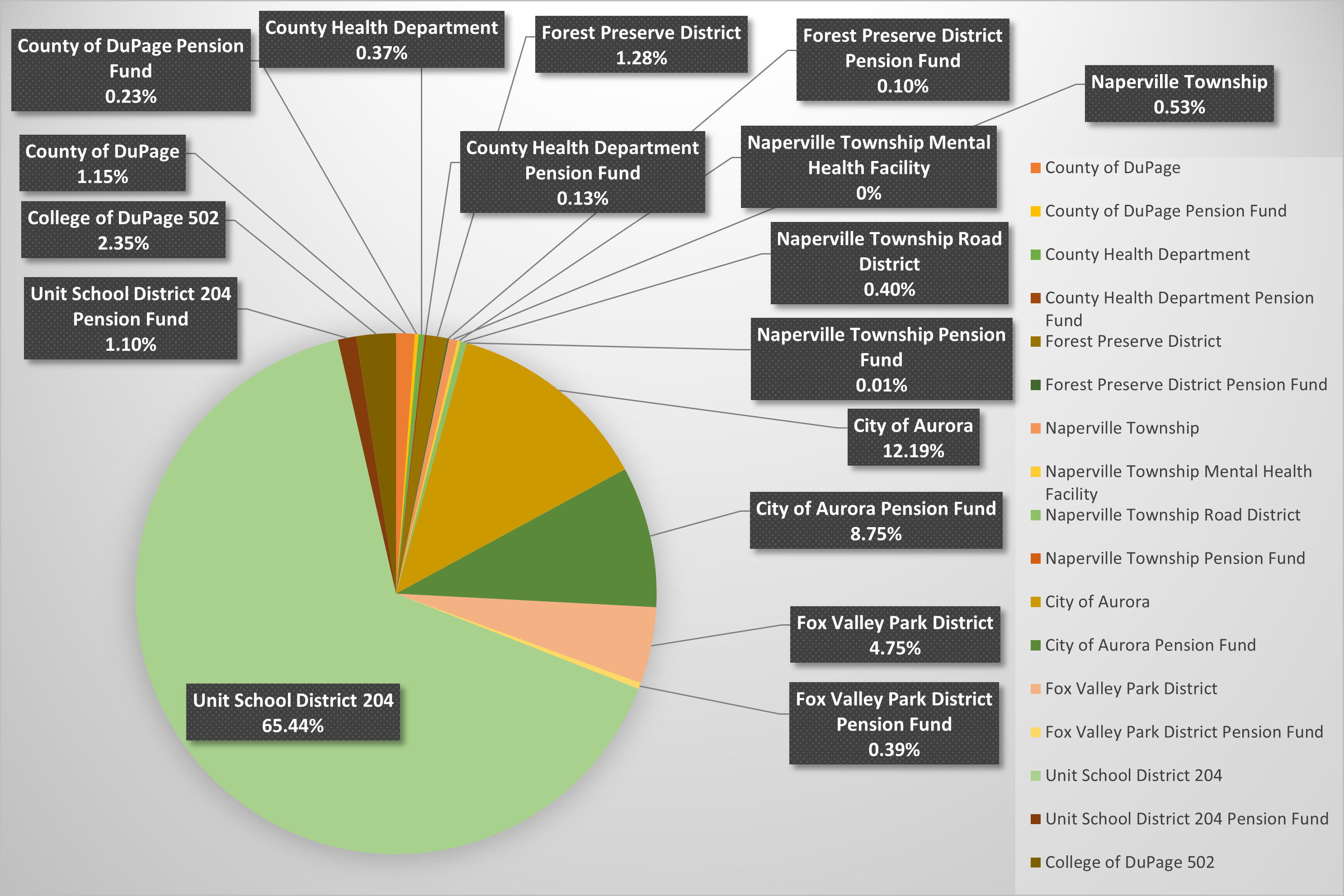

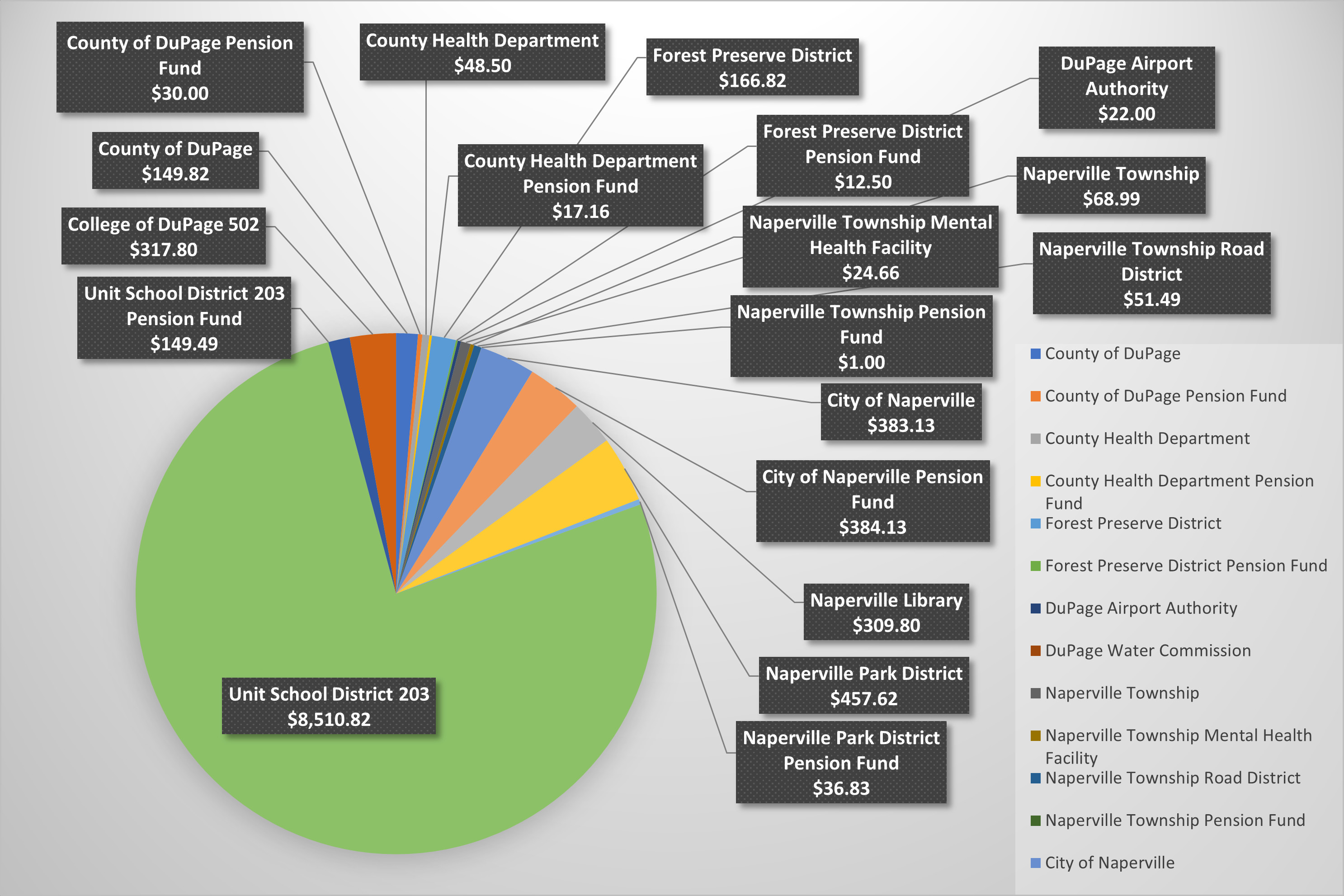

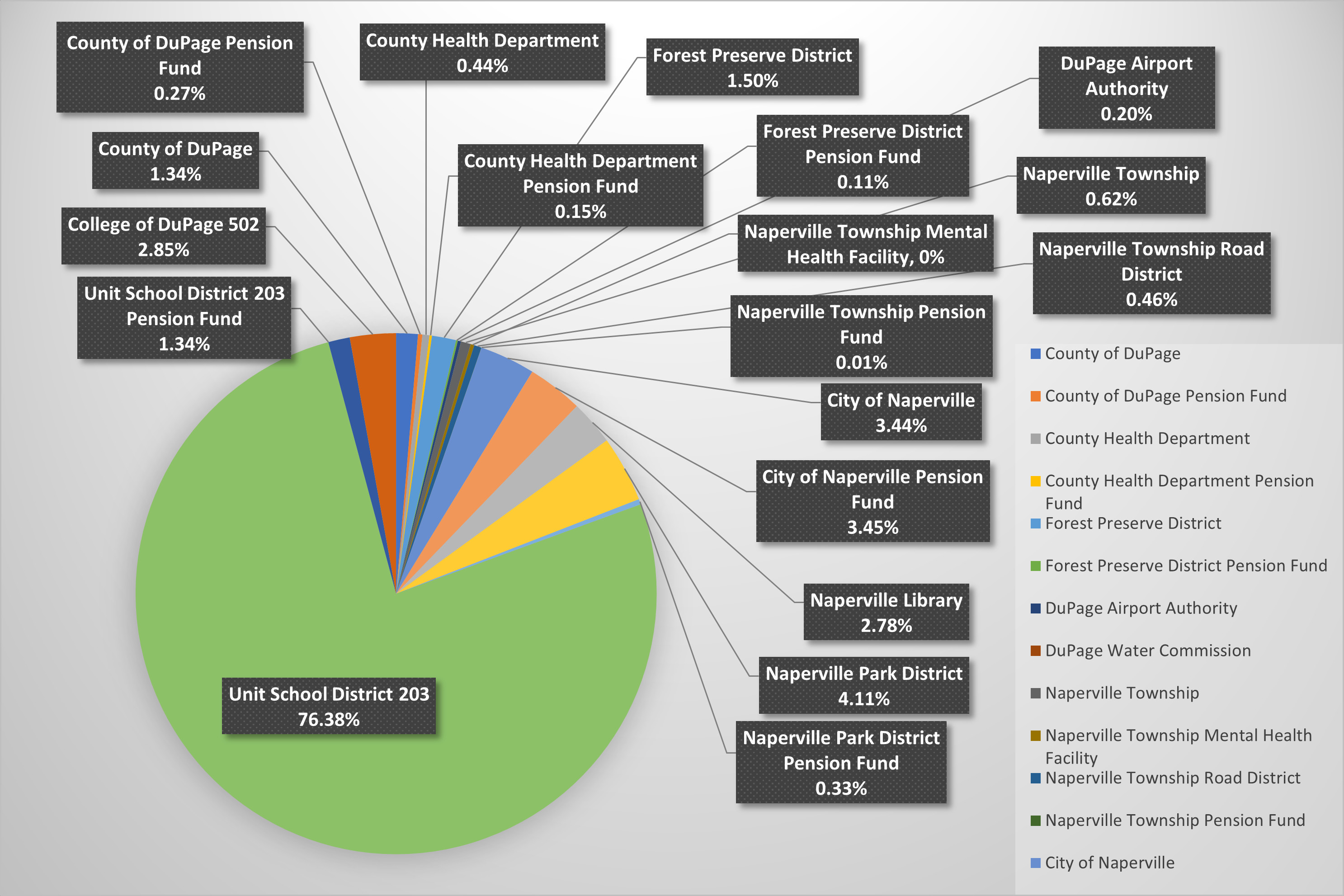

Your annual property taxes are made up of levies from the individual taxing bodies that service your area. Each taxing body determines how much money is needed to operate for the upcoming year, and how much needs to be raised through property taxes. The amount to be raised is the levy. The levy is sent to the County Clerk where the tax rate is calculated by dividing the total amount of assessed value in the jurisdiction by the levy. The following charts display the breakdown for a typical home in Aurora within School District 204, and one for a home in Naperville within School District 203 boundaries.

Your tax bill will list all the Taxing Districts that you are paying taxes to.

$500,000 Aurora Home in 2023 - Dollar Amounts Paid to Taxing Bodies

Typical Aurora Home in 2023 - Percentages of Tax Bill Paid to Taxing Bodies

$500,000 Naperville Home in 2023 - Dollar Amounts Paid to Taxing Bodies

Typical Naperville Home in 2023 - Percentages of Tax Bill Paid to Taxing Bodies

Dollar amounts and percentages will vary based on your geographic location within the township, the taxing bodies you are paying into, and the exemptions you qualify for. The sample homes used in the above charts do not have any exemptions applied. These values are in no way a guarantee of taxes owed and should not be used to estimate property taxes.